Every successful business—whether a local shop or a global company—relies on a solid financial plan. Without one, even the best ideas can fail. Business financial planning is more than just tracking income and expenses; it is a roadmap that guides growth, manages risks, and helps businesses make smarter decisions.

In fact, a QuickBooks 2024 survey found that 61% of small business owners who created a financial plan felt more confident in reaching their goals compared to those who did not. This shows that financial planning is not a luxury—it’s a necessity for growth.

What Is Business Financial Planning?

Business financial planning means creating a structured process to manage money in a way that supports long-term success. It includes:

- Setting financial goals,

- Creating budgets,

- Tracking cash flow,

- Planning for taxes,

- Forecasting future growth, and

- Managing risks.

Think of it like building a house. The blueprint is your financial plan—it tells you where to put your resources, how to build stronger foundations, and what to do if challenges come up.

Why Financial Planning Is the Key to Growth

Growth requires more than ambition. Businesses need both money and strategies to expand at the right pace. Here’s why financial planning plays a critical role:

1. Helps Manage Cash Flow

A CBInsights report found that 38% of startups fail because they run out of cash. With proper planning, businesses can avoid this by forecasting cash inflows and outflows.

2. Improves Decision-Making

Financial data allows business owners to make smart choices—whether it’s the right time to hire staff, launch new products, or invest in technology. Without a plan, these decisions are based on guesswork, which is risky.

3. Builds Investor Confidence

Investors and lenders want to see clear financial forecasts. A well-prepared financial plan shows professionalism and increases the chance of funding. According to a Harvard Business Review study, entrepreneurs with formal plans are 16% more likely to achieve viability than those without.

4. Prepares for Risks

From inflation to supply chain issues, risks are constant. Financial planning helps businesses build reserves and plan for uncertainties. A Deloitte 2023 survey revealed that 74% of executives view financial risk planning as a top priority.

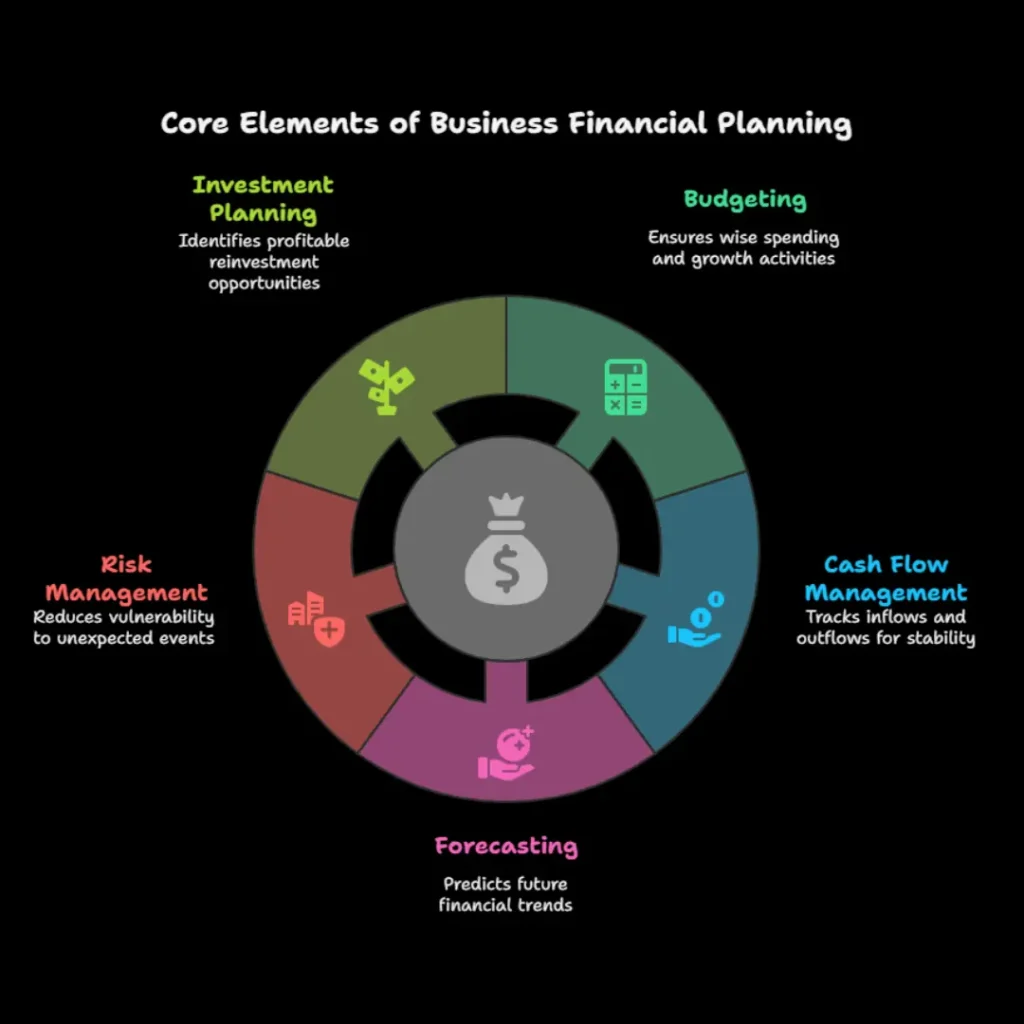

Core Elements of Business Financial Planning

1. Budgeting

Budgeting ensures money is spent wisely. A budget acts as a control system to prevent overspending and direct funds toward growth activities.

2. Cash Flow Management

Cash is the lifeblood of business. By tracking inflows and outflows, companies ensure they can pay bills on time while saving for future investments.

3. Forecasting

Financial forecasting predicts future revenue, expenses, and profits. According to Statista, analysts project the global financial forecasting market will reach $16.9 billion by 2028, proving its importance.

4. Risk Management

Unexpected events—like economic downturns or sudden cost increases—can damage a business. Setting aside emergency funds and planning for risks reduces vulnerability.

5. Investment Planning

Businesses that reinvest profits wisely often grow faster. Investment planning identifies where to put money—whether in marketing, technology, or expansion.

Steps to Build an Effective Business Financial Plan

- Set Clear Goals

- Define both short-term and long-term financial objectives. Example: Increase revenue by 20% in the next 12 months.

- Analyze Current Finances

- Review income statements, balance sheets, and cash flow reports.

- Create a Budget

- Allocate funds for operations, marketing, salaries, and growth initiatives.

- Forecast Revenue & Expenses

- Use past data to predict future outcomes.

- Plan for Taxes and Debt

- Include tax obligations and repayment schedules for loans.

- Build a Risk Strategy

- Save at least 3–6 months of operating expenses as a safety net.

- Monitor and Adjust

- Review the plan quarterly or annually. Growth requires flexibility.

Common Mistakes Businesses Make Without Financial Planning

- Overspending on non-essential expenses.

- Ignoring cash flow, which leads to sudden shortages.

- Failing to track performance, making it hard to spot problems early.

- No risk management, leaving the business unprepared for downturns.

- Lack of forecasting, which leads to missed opportunities.

The U.S. Bureau of Labor Statistics says that about 20% of new businesses fail in their first year. This often happens because of bad financial management.

Real-World Example

A small retail business in California invested in proper financial planning. By using simple budgeting software, it identified areas of waste and cut unnecessary expenses by 15%. These savings were reallocated toward online advertising. Within one year, sales increased by 25%.

On the other hand, a similar business without a financial plan had trouble with overdue bills. It had to borrow money at high interest rates. This limited growth and profitability.

These examples show that planning makes the difference between thriving and barely surviving.

Key Statistics and Insights

- 38% of startups fail due to cash flow issues (CBInsights, 2023).

- 61% of small business owners with financial plans feel more confident about growth (QuickBooks, 2024).

- The financial forecasting industry is expected to grow to $16.9 billion by 2028 (Statista, 2024).

- Businesses with structured planning are 30% more likely to grow faster than those without (U.S. SBA, 2023).

- 74% of executives rank risk planning as critical (Deloitte Global Survey, 2023).

Conclusion

Business financial planning is not just about crunching numbers—it’s about creating a path to growth. From budgeting and forecasting to managing risks and building investor trust, financial planning ensures that every decision supports long-term success.

No matter if you are a small startup or a growing company, a good financial plan is your best tool for stability and growth.

As the old saying goes: “Failing to plan is planning to fail.”

Now is the time to start building your financial plan because growth only happens when your money has a direction.

FAQs

1. What is financial planning in business?

Financial planning in business means creating a plan for how money will be earned, spent, saved, and invested. It helps businesses set goals, track performance, and prepare for future growth.

2. Why is financial planning important for small businesses?

Small businesses often have limited resources. Financial planning helps them avoid overspending, manage cash flow, and grow in a safe way. A CBInsights study shows that 38% of startups fail because of cash flow problems, which can be prevented with a good financial plan.

3. What happens if a business has no financial plan?

Without a financial plan, businesses may run out of cash, miss tax payments, overspend, or struggle to attract investors. This often leads to failure or slow growth.

4. How often should a business review its financial plan?

Experts recommend reviewing a financial plan at least once a year. However, fast-growing businesses or those facing economic changes should check it every quarter.

5. Can financial planning help in getting investors?

Yes. Investors want to see clear numbers and forecasts before they give money. A structured financial plan builds trust and increases the chance of securing funding.

6. What tools can small businesses use for financial planning?

Small businesses can use tools like QuickBooks, Xero, FreshBooks, and Excel for budgeting, cash flow management, and forecasting. Many of these tools are beginner-friendly and affordable.

7. What is the difference between budgeting and financial planning?

- Budgeting = deciding how to spend money month by month.

- Financial planning = a bigger picture strategy that includes budgeting, forecasting, risk management, and long-term growth planning.

8. How does financial planning reduce risks?

Financial planning helps businesses prepare for emergencies (like inflation, supply chain issues, or sudden losses) by building savings, cutting waste, and creating backup strategies.

9. Do all businesses need financial planning?

Yes. Whether it’s a small local shop or a large corporation, every business needs financial planning. The scale may differ, but the need to manage money wisely is the same.

10. How does financial planning support business growth?

Financial planning gives direction. It ensures money is used for the right things, like marketing, hiring, and expansion. With a clear plan, businesses can grow faster and more safely.

Leave a comment